Searching for steady income?

We’ve got you covered

Unlock targeted higher income from no-yield or lower-yielding assets

- Pursue predefined higher income in dynamic markets

- Participate in potential future growth

- Reduce relative sensitivity to interest rates

- Available on equities, fixed income, cryptocurrency and commodities

Why invest in the Target Income Strategy?

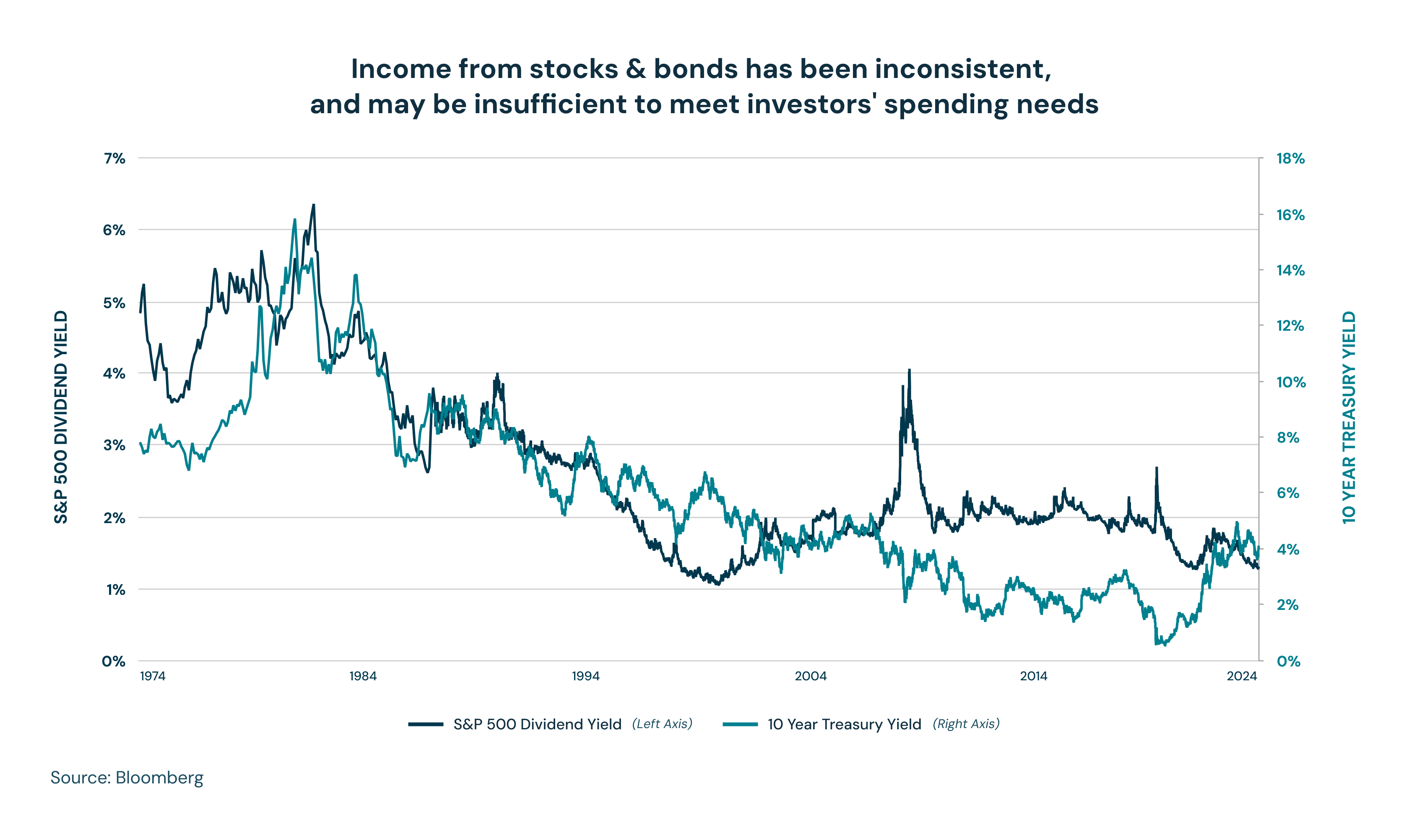

Most income-focused investors require consistent cash flow to meet their expenses or financial goals. However, the yields from income-generating assets, such as bonds, dividend-paying stocks, and real estate, can vary widely due to factors like interest rate changes, market conditions and economic shifts.

The Target Income Strategy® seeks to reduce investors' exposure to the income gyrations of the markets, by dynamically working under the surface to pursue a steady and consistent level of income. It is a dynamic strategy that, when applied on a particular asset, responds to changing market conditions to bridge the gap between income needs and the income that asset yields.

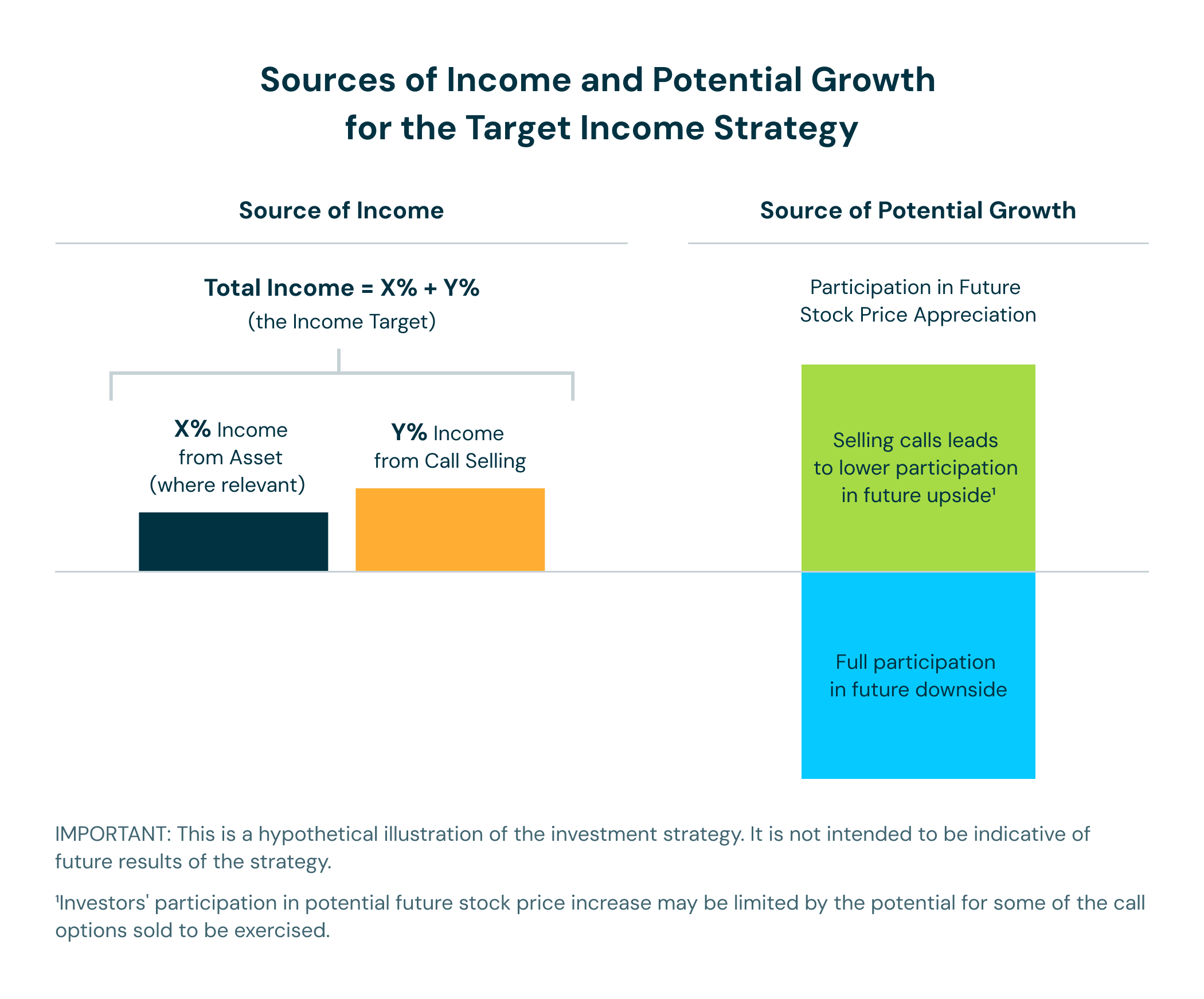

The strategy augments income by converting some of the future uncertain growth of the asset into certain upfront income using options.

In their search for yield, income-focused investors can skew their portfolio away from assets that may produce growth but not (as much) income. Attaching a high weight to an investment's income properties in deciding how much to hold means:

- Missing out on key parts of the economy, such as high-growth technology stocks that don’t pay dividends, or

- Foregoing investments that offer desirable diversifying properties (e.g., commodities such as gold, oil, and agricultural goods) that don’t yield income, or

- Failure to keep pace with inflation

The Target Income Strategy uses options selling to strike the right balance between growth and income in continuously changing market conditions. It seeks to sell just the right amount of call options to convert some of the future uncertain growth to current premium income. By doing so it unlocks income from growth assets, allowing them to be added to traditional income portfolios.

Income investors may hold high levels of fixed income in their portfolios to meet their income needs. This may expose them to higher amounts of interest rate risk. During periods of interest rate volatility, investors may see their incomes fall as interest rates fall or may see price depreciation in fixed income positions when interest rates rise.

The Target Income Strategy seeks to generate income from premiums received from sale of options – which are not meaningfully impacted by interest rates. By deploying a larger allocation from fixed income to the Target Income Strategy, income investors can reduce sensitivity to changes in interest rates.

How it works

The strategy seeks to achieve a targeted level of income and has four key elements

- Underlying Asset or asset class

The strategy can be applied on a wide spectrum of assets. Examples include technology stocks, high yield bonds or Gold. Part of the income to achieve the target may come from any income yielded by the underlying assets. Such income could include dividends from stocks or coupons from bonds. Some assets, such as Gold, may yield no income.

- Selling Calls

The strategy seeks to generate additional income from selling call options. Call options sold result in the strategy collecting premiums upfront. However, any payouts from settling the calls at their expiry results in a drag on the appreciation in the underlying assets.

- Partial Overwrite

Instead of selling calls against the entire underlying positions, the strategy sells calls only against a partial position. The number of calls sold is such that the premiums collected from the call selling and any income collected from the underlying asset together result in meeting the income targets. Selling (or "writing") calls over a partial position also allows the strategy to participate in potential growth from appreciation in the underlying assets. For a deeper dive on partial vs. full overwrite strategies, click here .

- Dynamically adjusted over the short term

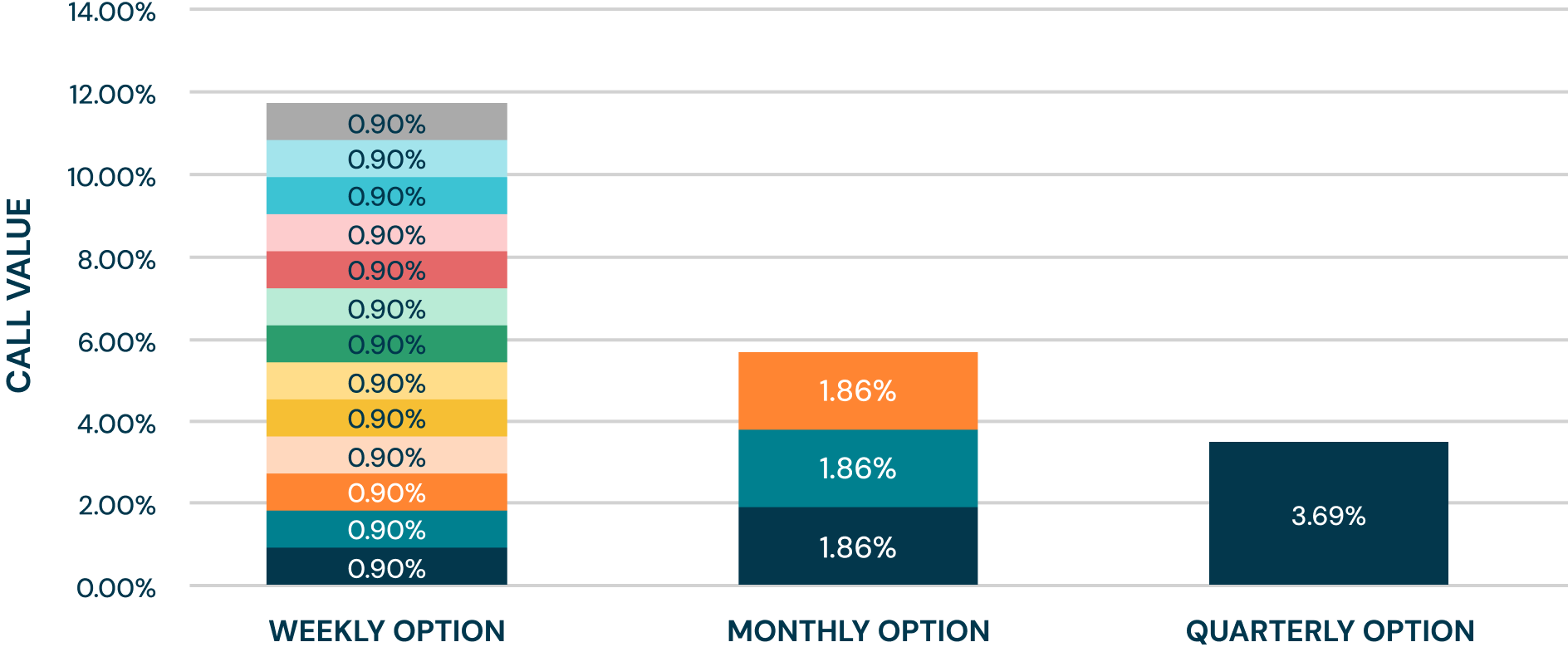

- The strategy collects higher levels of premium by rolling shorter-dated calls than longer-dated calls over the same period.

- The strategy calibrates to changing market conditions more dynamically, allowing it to meet its target income mandate more consistently.

The Target Income Strategy is designed to provide investors with a pre-defined level of income from a wide range of assets. The strategy seeks to augment income by converting some of the uncertain future growth of an asset into more certain upfront income. The strategy seeks to strike a dynamically changing balance between growth and income, “converting” just the right amount of an asset's potential growth into income to achieve a predetermined level of Target Income on a consistent basis.

How to invest

The Target Income Strategy can be applied to a wide range of underlying assets. The strategy is currently available on the following underlyings in exchange-traded funds (“ETFs”) and mutual funds for which Vest serves the advisor or subadvisor:

| Dividend & Quality Stocks | Technology Stocks | Alternative Assets | Fixed Income |

|---|---|---|---|

| Underlying Assets | |||

|

|

|

|

Resources & FAQs

FAQs

What is a call option?

What is a covered call strategy?

What is a partial call option selling strategy?

Why is the partial call strategy key?

Why are at-the-money (ATM) options preferred for Target Income?

What is the rationale for short-term vs long-dated options for Target Income?

Why do short-term options produce greater income than long-term options?

How complex is the Target Income Strategy?