Target Buffer Strategies

for Retirement Risk Management

What is the Target Buffer Strategy?

The target buffer strategy is an options-based risk management strategy designed to:

- Protect (or “buffer”) against a targeted level of losses in declining equity markets.

- Participate in gains to a predetermined cap in rising equity markets.

This two-minute video shows how the target buffer strategy works.

Why Invest?

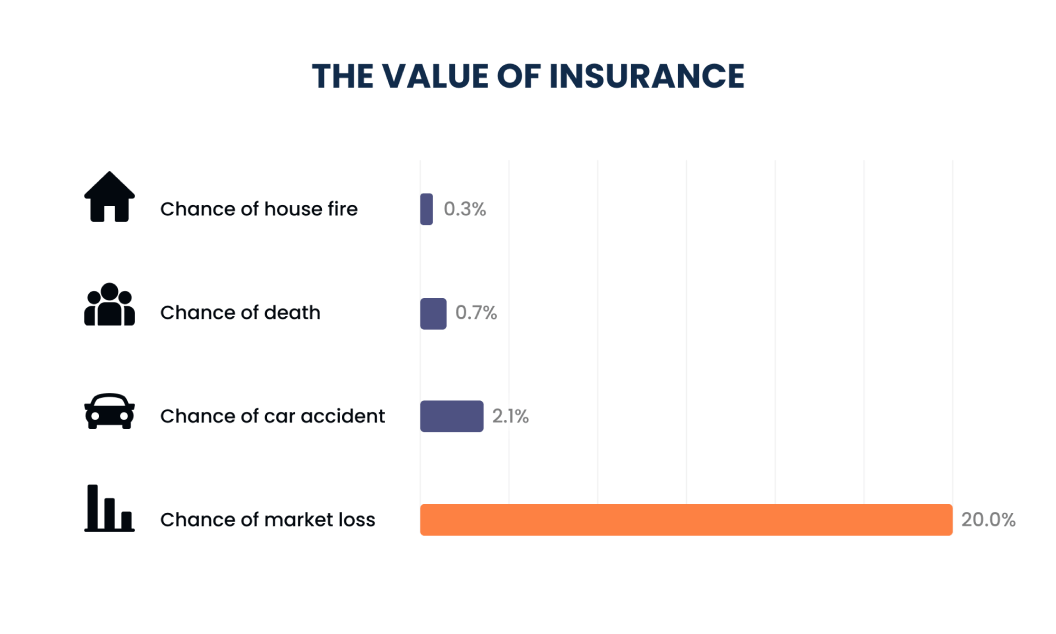

We buy insurance on our homes, on our cars and even on our lives. However, in any given year with a 20% chance of market loss, why don’t more investors seek to protect their retirement savings?

Equities offer promising growth potential for investments, but they can be severely affected by events that are difficult to predict. Losses can have a greater impact on portfolios than gains, because the money left after the loss has to work harder just to get back to the original levels—if the time horizon is long enough. Investors in or near retirement who experience a down market may not be able to benefit from a future recovery.

The target buffer strategy offers an innovative approach that seeks to strike the right balance: aiming to provide a persistent level of protection to equity exposure while allowing investors to participate in some of the potential growth opportunities that equities provide.

401(k) and pension plans often rely on diversifying equities with bonds to help minimize the risk of loss. But this strategy may be challenged in some market environments.

- 60/40 may not be the answer

Many portfolios include an allocation to fixed income as a counterbalance to equities during times of market volatility.

However, the traditional correlation between stocks and bonds has shifted over the past few decades, with a greater tendency to move in the same direction. During market downturns, the increased correlation between stocks and bonds can lead to larger losses for investors who rely on traditional portfolio construction.

Fixed income may also be challenged when interest rates rise and lose purchasing power in an inflationary environment.

When will the next pullback occur, or when will interest rates and inflation stabilize? While it’s not possible to predict the future, there are ways we can prepare for it. The Target buffer strategy seeks to protect equity investors from losses with a contractual level of certainty (“contractual certainty”) that is simply not possible with a 60/40 allocation. The contractual certainty comes from options. To understand the contractual nature of options and why it matters, click here.

How It Works

The target buffer strategy has four basic elements:

- Reference asset

An exchange-traded fund (ETF) or index, such as SPDR® S&P 500 ETF Trust (SPY) or S&P 500 Index (SPX).

- Buffer level

The target buffer is set for the reference asset at the start of each outcome period based on volatility and other factors. Typical buffer levels in retirement are from 0% to -10%, -5% to -20%, and 0% to -20%.

- Outcome period

A period in which losses are buffered (for example, three months, six months or one year)

- Upside cap

Typically, there is a cap on potential upside gains, which pays for the downside buffer. The cap is set at the start of the outcome period based on prevailing market conditions.

The strategy seeks outcomes (before fees and expenses) that are a function of the level of the reference asset at the end of the outcome period relative to its level at the start, as illustrated below

If the reference asset appreciates more than the cap level:

The target buffer strategy seeks to provide an outcome aligned with the predetermined cap level.

If the reference asset appreciates, but less than the cap level:

The target buffer strategy seeks to provide an outcome that increases by the percentage increase of the reference asset, up to the predetermined level.

If the reference asset decreases by less than the buffer:

The target buffer strategy seeks not to participate in such losses.

If the reference asset decreases by more than the buffer:

The target buffer strategy seeks to provide an outcome that is better than the price returns of the reference asset by the buffer percentage.

Funds

Retirement-specific buffer strategies are available in mutual funds and collective investment trusts (CITs) with different levels of protection.

The Vest Moderate Buffer 20 Strategy seeks, before fees and expenses, to provide S&P 500 exposure to a cap, while attempting to buffer losses from -5% to -20% over a three-month period.

The Vest Conservative Buffer 20 Strategy seeks, before fees and expenses, to provide S&P 500 exposure to a cap, while attempting to buffer losses from 0% to -20% over a six-month period

Resources

DERIVATIVE SECURITIES RISK

The strategies invest in derivative securities. These financial instruments derive their performance from the performance of an underlying asset or index and can be volatile. A strategy could experience a loss if derivatives do not perform as anticipated, or are not correlated with the performance of other investments which are used to hedge, or if the strategy is unable to liquidate a position because of an illiquid secondary market.