Vest S&P 500® Dividend Aristocrats Target Income Fund

Combining Income With Growth

Income

Growth

Why Invest in This Fund

Traditionally, investors seek to meet their income needs through fixed coupon investments such as bonds. However, bonds can struggle to deliver when yields are low, inflation erodes principal, or when interest rates rise (driving down bond prices).

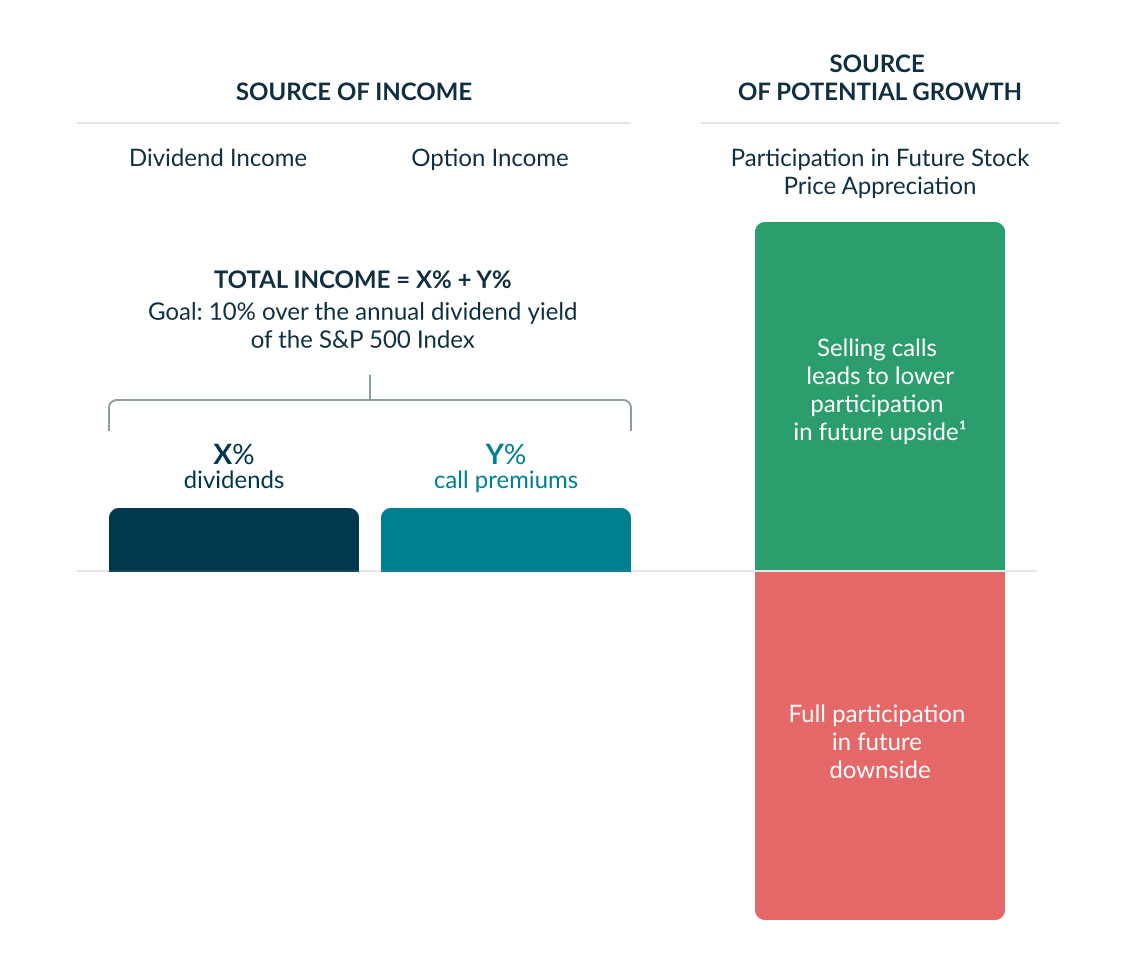

The Fund offers an innovative approach that aims to combine income from two unique sources: dividends from stocks and premium income from stock options. It does so while seeking to retain the majority of the inflation-beating growth characteristics of stocks.

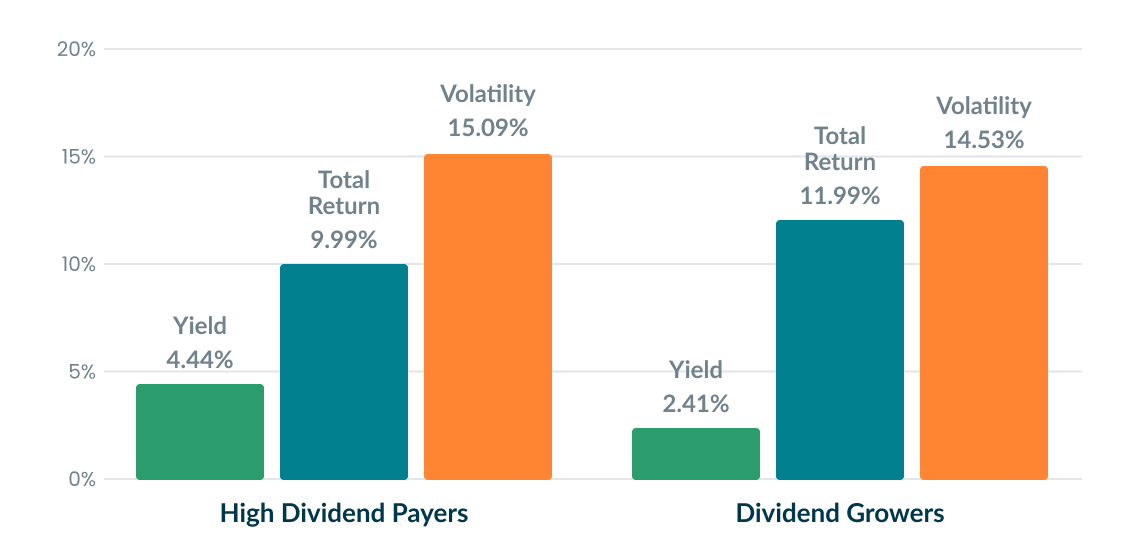

Within dividend-paying equities, investors face a trade-off between the level of income and quality of stocks as measured by the volatility of their prices.

- High dividend stocks (such as the Dow Jones U.S. Select Dividend Index) pay higher-than-average dividends, but they have historically delivered lower total returns with higher volatility.

- Dividend grower stocks (such as the S&P 500 Dividend Aristocrats Index) focus on consistently increasing their dividends over time and deliver higher-than-average total returns and lower volatility, but with lower dividend yields.

The Fund seeks to solve this dilemma by selecting the higher-quality dividend grower stocks and selling call options on some of the stock holdings to generate additional income.

How It Works

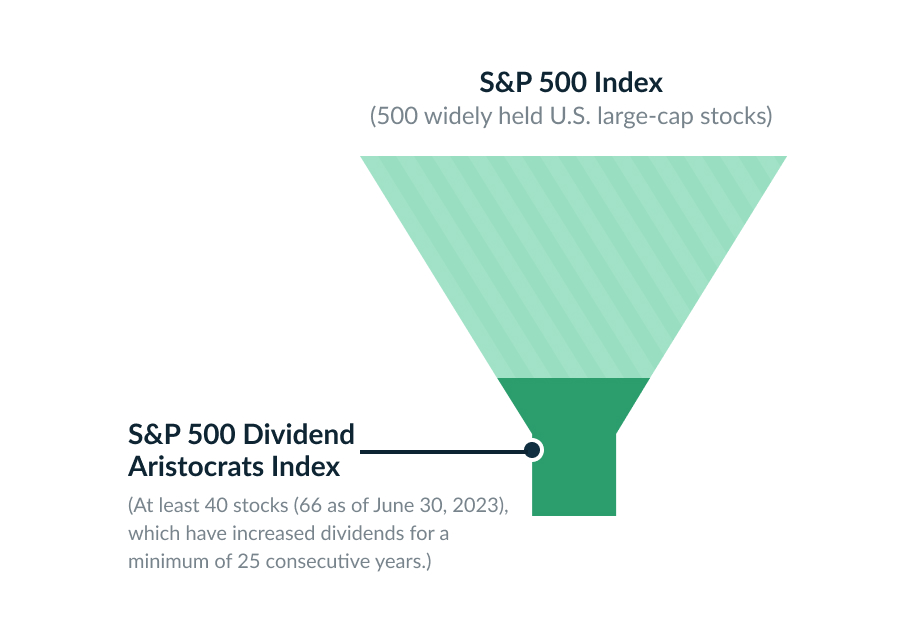

The stock portfolio consists of stocks from the S&P 500 that have increased dividend payments each year for at least 25 years. The portfolio is equally weighted and well diversified across all sectors, and meets market capitalization and liquidity requirements.

The selection targets economically advantaged companies that consistently raise their dividends and grow fast enough to keep ahead of inflation. As a result, the portfolio has both capital growth and dividend income characteristics.

The strategy seeks to reach its income target of 10% over the S&P 500 annual dividend yield from two sources:

- The dividends from the stock portfolio

- Premiums collected by selling calls on a portion of the stocks

A partial call selling strategy seeks to convert a portion of a stock's potential growth into current income. Each week, the Fund compares the dividend income of the stock portfolio against the target income and looks to bridge that difference with the premiums that come from selling calls on a portion of the stocks. By combining premiums collected from the sale of the calls with the dividend income of the stocks, investors may increase their total income while still participating in some of the growth potential from the price appreciation of the stocks.

The call options are sold with an approximate term of seven days. The strike price of each call option is as close as possible to the closing price of the option’s underlying stock price at the beginning of each term.

Where It Fits in the Portfolio

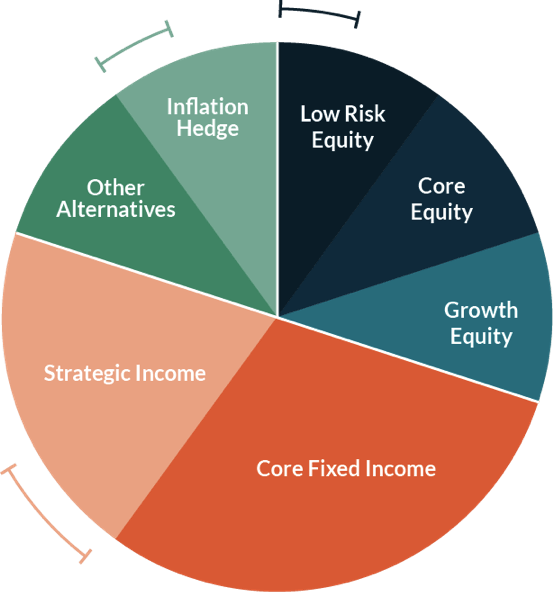

The Fund can fit in three places in an investor's portfolio:

- Strategic income allocation, for the income that seeks to outpace inflation

- Strategic core (low risk) large-cap equity allocation, for the total returns

- Inflation hedge allocation

Additional Resources & FAQs

Regulatory Documents

FAQs

What is a call option?

What is a covered call strategy?

What is a partial call option selling strategy?

How does the fund choose which stocks to cover and where to sell the calls?

Where could investors consider using this strategy in their portfolios?

When was The Vest Dividend Aristocrats Target Income Fund launched?

When does the Fund pay out distributions and what is the makeup of these distributions?

What are the tax implications of the strategy?

What is the breakdown of income from options vs dividends?

What is the net distribution after fees and expenses?

Will a partial call selling strategy underperform if the stock appreciates over a week?

How does the methodology characterize and assess the risk/reward trade-offs of using the weekly call-selling employed in The Vest S&P 500 Dividend Aristocrats Target Income Fund, versus the quarterly options that are more typically used in more common call-selling strategies?

Performance (KNGIX — Institutional Share Class)

The Two Components of Yield

The Fund distributes returns from two sources:

- Dividend Income from its stock positions

- Short-Term Capital Gains, such as options premiums, collected from selling calls

| Quarter End Performance (as of 12/31/2025) |

|---|

Performance data quoted represents past performance. The Funds’ past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Funds may be lower or higher than the performance data quoted. You may obtain performance data current to the most recent month end by calling 855-505-VEST (8378).

*Since share classes have different sales charges, fees, and other features, the performance of other share classes may differ from the performance listed for Institutional class shares.

Definitions and Key Terms:

30-Day SEC Yield: The SEC yield is a standard yield calculation developed by the U.S. Securities and Exchange Commission (SEC) that allows for fairer comparisons of bond funds. It is based on the most recent 30-day period covered by the fund's filings with the SEC. The 30-day SEC Yield reflects the dividends and interest earned during the period after the deduction of the fund's expenses. The Subsidized yield includes contractual expense reductions and it would be lower without those reductions. The Unsubsidized yield excludes contractual expense reductions. Annualized Yield: Calculated by taking the sum of all the Periodic Distribution Rates over the past 12 months. Annualized Yield numbers are based on historical distributions and NAVs and are not predictive of future distributions or yields. Annualized Yield is calculated to provide a sense of the total cash flow associated with investment in the fund, but should not be confused with SEC yield, dividend yield or interest yield. Periodic Distribution Rate: Calculated by taking the total distribution and dividing it by the NAV on that date.

Fund Facts & Stats

Fund Snapshot

Expenses

- Gross Expense Ratio1.29%

- Net Expense Ratio*0.95%

Estimated Distributions

The power of derivatives, simplified

Build more certainty into portfolios with defined outcomes.

Let’s connectImportant Disclosures, Please Read

Investors should consider the investment objectives, potential risks, management fees and charges and expenses carefully before investing. This and other information is contained in the Fund’s prospectus, which may be obtained online, or by calling 855-505-VEST (8378). Please read the prospectus carefully before investing. Distributed by Foreside Fund Services, LLC, Portland, ME. Member FINRA/SIPC.

View this firm's background on FINRA's BrokerCheck.

On January 2, 2024, the Fund’s name changed from Cboe Vest S&P 500® Dividend Aristocrats Target Income Fund to Vest S&P 500® Dividend Aristocrats Target Income Fund. This is a change in name only; the Fund’s objective and principal investment strategy remain the same.

Any comments or statements made herein do not reflect the views of Vest Group Inc. or any of their subsidiaries or affiliates.

Definitions and Key Terms

Cboe S&P 500 Dividend Aristocrats Target Income Index (SPAI): The Index is designed with the primary goal of generating an annualized level of income that is approximately 10% over the annual dividend yield of the S&P 500 Index, and a secondary goal of generating price returns that are proportional to the price appreciation of the S&P 500 Index.

Cboe S&P 500 Dividend Aristocrats Target Income Index Monthly Series (SPATI): The Index is designed with the primary goal of generating an annualized level of income that is approximately 8% over the annual dividend yield of the S&P 500 Index and a secondary goal of generating price returns that are proportional to the price appreciation of the S&P 500 Index.

Covered call: A covered call is an options strategy whereby an investor holds a long position in a stock and sells (also referred to as "writes") call options on that same stock in an attempt to generate increased income from the stock. A covered call is also known as a "buy-write".

Dividend Growers are represented by the S&P 500 Dividend Aristocrats Index. S&P 500 Dividend Aristocrats measure the performance of S&P 500 companies that have increased dividends every year for the last 25 consecutive years. The Index treats each constituent as a distinct investment opportunity without regard to its size by equally weighting each company.

High Dividend Payers are represented by the Dow Jones U.S. Select Dividend Index, which aims to represent the U.S.’s leading stocks by dividend yield.

S&P 500 Index: The index includes 500 leading companies and captures approximately 80% coverage of available market capitalization. The index is widely regarded as the best single gauge of large-cap U.S. equities.

Strike price: A strike price is the price at which a specific derivative contract can be exercised. For call options, the strike price is where the security can be bought (up to the expiration date); for put options, the strike price is the price at which shares can be sold.

Risk Factors

Call Options Risk. Writing call options are speculative activities and entail greater than ordinary investment risks. The Fund’s use of derivatives, such as call options, can lead to losses because of adverse movements in the price or value of the underlying stock, which may be magnified by certain features of the options.

FLEX Options Risk. The Fund expects to utilize FLEX Options issued and guaranteed for settlement by the Options Clearing Corporation (OCC). The Fund bears the risk that the OCC will be unable or unwilling to perform its obligations under the FLEX Options contracts. Additionally, FLEX Options may be less liquid than certain other securities, such as standardized options.

Portfolio Turnover Risk. The Fund’s strategy will frequently involve buying and selling call options to generate premium income. High portfolio turnover may result in the Fund paying higher levels of transaction costs and generating greater tax liabilities for shareholders.

Please see the prospectus for more information regarding these and other risks associated with the Fund.

© 2025 Vest Group Inc. All rights reserved.

Vest Trademarks & Copyrights

Vest Financial LLC is an investment advisory firm registered with the U.S. Securities and Exchange Commission (SEC). Registration does not imply a certain level of skill or training. Vest Financial LLC is a wholly owned subsidiary of Vest Group Inc. Vest offers institutional-quality Target Outcome Investments(R) built on the backbone of its unique investment philosophy—that strive to buffer losses, amplify gains or provide consistent income — to a diverse spectrum of investors.