RYSE

Vest 10 - Year

Interest Rate Hedge ETF

Interest Rate Hedge ETF

The first targeted ETF seeking to generate capital appreciation from an increase in the 10 - year interest rate.

Why Invest

Portfolios are continuously exposed to risk resulting from changes in interest rates. If interest rates rise, the value of a bond or other fixed-income investment in the secondary market will decline. Other assets in multi-asset portfolios, such as equities, may also be susceptible to interest rate fluctuations.

In a world where many assets may decline in value when rates rise, Vest 10-Year Interest Rate Hedge ETF (RYSE) provides a much-needed alternative. Structured to benefit from an increase in the 10-year rate, the ETF can be used in a typical portfolio to offset some of the risk of rising interest rates.

Learn how interest rates affect bonds and equities

Interest rates peaked in the early 1980s and declined to nearly zero over the next four decades.

Lulled by declining rates over this long period, many investors did not fully appreciate the risks of interest rate increases. So, the rate hikes that began in 2022 in response to inflation led to broad and sustained declines in portfolio values, revealing investors’ unpreparedness for a rising rate regime. RYSE seeks to remedy this by providing a distinctive tool to counteract rising interest rates.

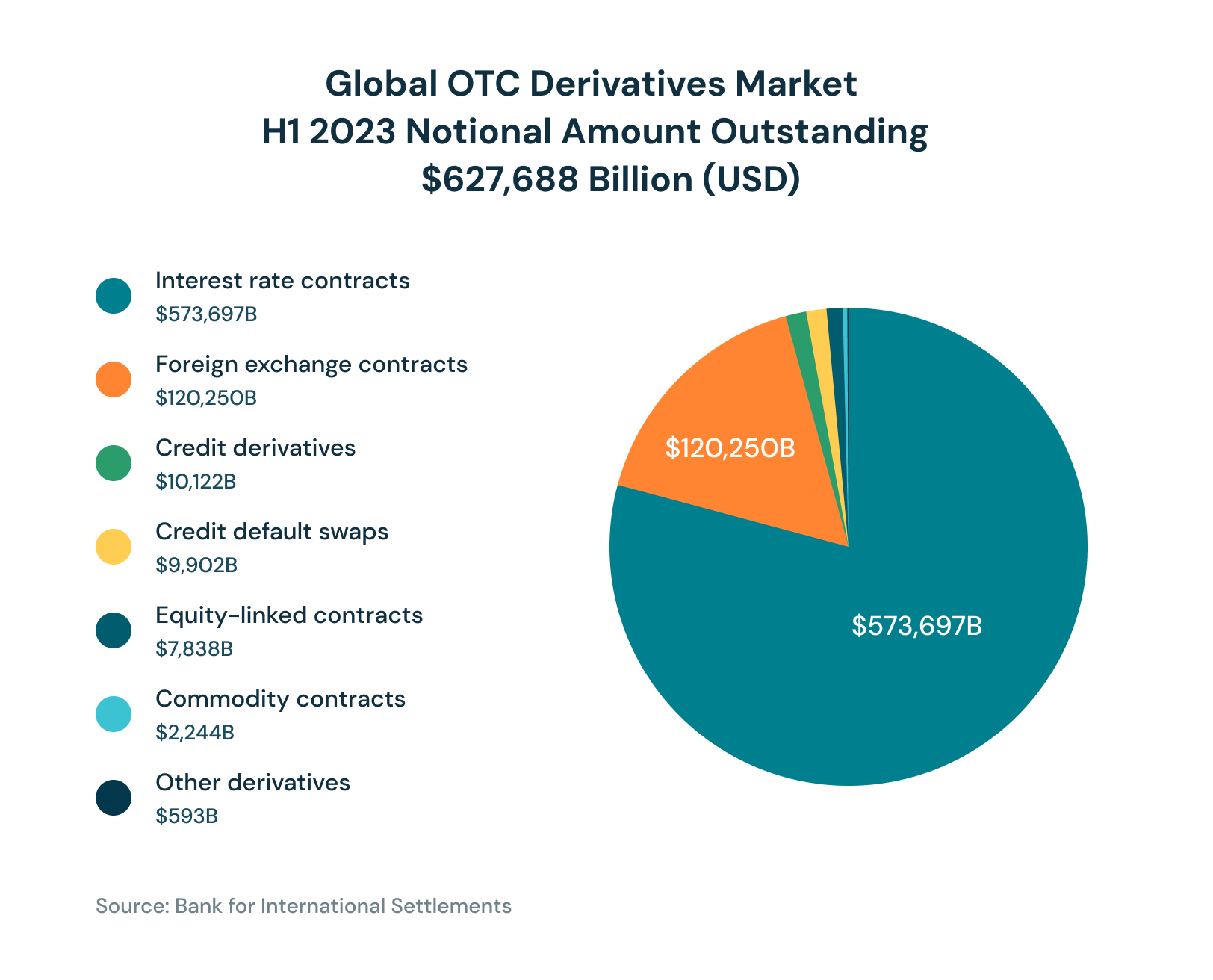

While a broad set of investors may be largely unprepared for interest rate risk, institutional investors have sophisticated tools, including interest rate-linked derivatives, to hedge such risks. In fact, the global market value of interest rate-linked derivatives is bigger than the market for derivatives for all other asset classes, including foreign exchange, equities, credit and commodities, combined.

Unfortunately, interest rate hedging solutions have, until recently, largely been out of reach for a broader set of investors. RYSE seeks to change that.

RYSE provides access to institutional-quality targeted interest rate hedging, with the convenience of a broadly accessible exchange-traded fund (ETF).

How It Works

RYSE seeks to generate capital appreciation from rising 10-year interest rates. The fund is designed to deliver a specific outcome over a calendar quarter (“quarter”):

- RYSE seeks to deliver positive returns, before any fees and expenses, when the 10-year rate rises; RYSE is expected to experience losses when the 10-year rate falls.

- Before fees and expenses, RYSE will generally: seek to limit losses to a maximum loss of 15%, with the potential upside generally capped between 10% to 35%. The upside cap range could be more or less from quarter to quarter depending on market conditions.

To achieve its investment objective, RYSE invests in options on interest rate swaps, known as “interest rate swaptions.” Each quarter, the fund purchases and sells swaptions to create the downside limits to losses (“floor”) and upside caps to gains (“cap”).

Where It Fits

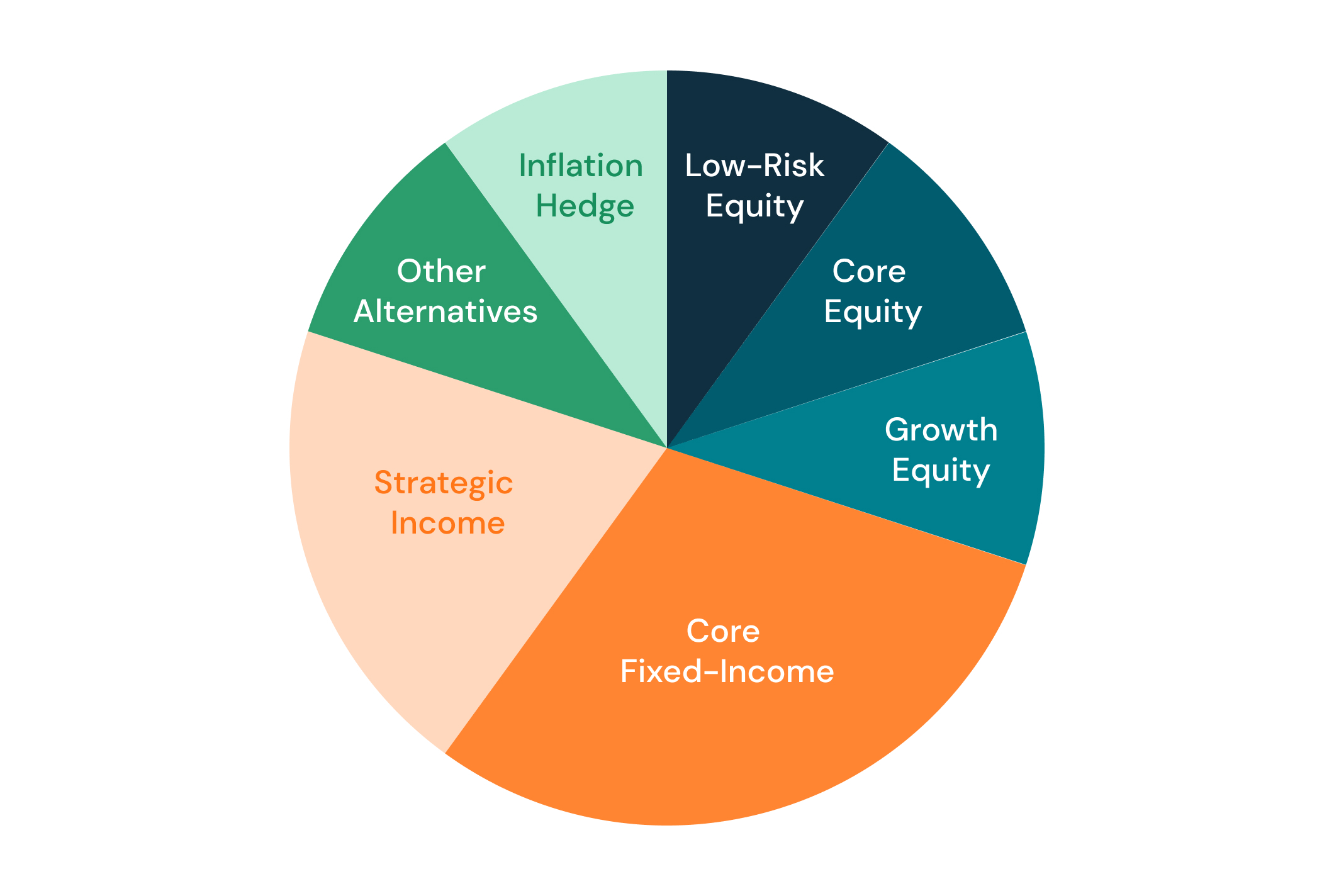

RYSE is structured to have a positive sensitivity to the rise in the 10-year rate. This allows it to serve as an alternative to conventional asset classes, which tend to depreciate in a rising rate environment. The fund can fit in four places in an investor’s portfolio:

Fixed-income allocation: As an offset to bond duration risks.

Equity sleeves: As a hedge against stocks (particularly longer-duration growth stocks) depreciating from rising interest rates.

Alternatives: Structurally designed to behave as an alternative to conventional asset classes.

Inflation hedge: Since rising interest rates can be triggered by an increase in inflation, in select conditions, RYSE may also be used as a hedge against rising inflation.

Performance

| Values as of | |||

|---|---|---|---|

| Fund NAV Total Return info | Remaining Outcome Period info | ||

| - | - | - | |

| Outcome Period Values (Current/Net) info | |||

|---|---|---|---|

| Cap info | Floor info | Outcome Period Dates info | Outcome Period info |

| - | - | - | - |

This tool is for information purposes only. It is not an offer to sell a strategy or an investment product. The charts and/or graphs contained herein are for educational purposes only and should not be used to predict security prices or market levels. Current figures are net of accrued Outcome Period expenses to date. Net figures include Outcome Period expenses yet to be incurred. Fund NAV Total Return and current outcome period values include reinvestment of capital gain distributions, if any, made over the Outcome Period. You should not draw any inferences about remaining cap levels from the current price of the fund and the Outcome Period cap shown. The Chicago Board Options Exchange 10-Year T-Note Index is based on the yield-to-maturity of the most recently auctioned 10-yr T-note. The index is calculated by multiplying the T-note YTM by a factor of 10. There can be no guarantee that the Fund will be successful in its strategy to provide protection against declines below a floor in the 10-year rate over a calendar quarter. It is not possible to invest directly in an index.

The Outcome Period Values (Cap and Floor) are shown both gross and net of fees. The outcome values may only be realized for an investor who holds shares for the entire outcome period. Investors purchasing the fund intra-period will achieve a different target outcome than those who entered on day one.

Standardized fund performance can be found below.

| Cumulative | 1 Month | 3 Month | 6 Month | YTD | 1 Year | Since Inception |

|---|---|---|---|---|---|---|

| Fund NAV | 3.22% | 2.71% | 1.58% | -3.75% | - | 21.69% |

| Fund Market Price | 4.18% | 2.89% | 3.45% | -3.07% | - | 22.16% |

| Annualized | 1 Year | 3 Year | 5 Year | Since Inception | ||

|---|---|---|---|---|---|---|

| Fund NAV | -3.75% | - | - | 6.98% | ||

| Fund Market Price | -3.07% | - | - | 7.12% | ||

Performance data quoted represents past performance. Past performance is not a guarantee of future results and current performance may be higher or lower than performance quoted. Investment returns and principal value will fluctuate and shares when sold or redeemed, may be worth more or less than their original cost.

For the most recent month-end performance, please call 855-505-VEST (8378).

The NAV represents the fund's net assets (assets less liabilities) divided by the fund's outstanding shares.

Market Price returns are determined by using the midpoint of the national best bid offer price ("NBBO") as of the time that the fund's NAV is calculated. Returns are average annualized total returns, except those for periods of less than one year, which are cumulative.

Fund shares are purchased and sold on an exchange at their market price rather than net asset value (NAV), which may cause the shares to trade at a price greater than NAV (premium) or less than NAV (discount).

The median bid-ask spread is calculated by identifying the national best bid and national best offer ("NBBO") for the fund as of the end of each 10 second interval during each trading day of the last 30 calendar days and dividing the difference between each such bid and offer by the midpoint of the NBBO. The median of those values is identified and that value is expressed as a percentage rounded to the nearest hundredth.

Inception Date is 2/02/2023.

Distributions

Fund Overview

- Gross Expense Ratio0.88%

- NAV as of 02-02-2026$23.75

- Market Price as of 02-02-2026$23.74

- Premium/Discount as of 02-02-2026-0.04

Additional Resources & FAQs

Regulatory Documents

FAQs

How are the caps set?

How are the floors set?

Why are the caps reset after each quarter?

What is duration?

What are options?

What is an interest rate derivative?

What is a financial instrument?

What is a derivative?

What is an interest rate swaption?

What is a swap?

What is a hedge?

The power of derivatives, simplified

Build more certainty into portfolios with defined outcomes.

Let’s connectImportant Disclosures, Please Read

Investors should consider the investment objectives, potential risks, management fees, and charges and expenses carefully before investing. This and other information is contained in the Fund’s prospectus, which may be obtained online, or by calling 855-505-VEST (8378). Please read the prospectus carefully before investing. Distributed by Quasar Distributors LLC. Member FINRA/SIPC.

View this firm's background on FINRA's BrokerCheck..

On January 2, 2024, the Fund’s name changed from Cboe Vest 10 Year Interest Rate Hedge ETF to Vest 10 Year Interest Rate Hedge ETF. This is a change in name only; the Fund’s objective and principal investment strategy remain the same.

Any comments or statements made herein do not reflect the views of Vest Group Inc. or any of their subsidiaries or affiliates.

The trademarks and service marks appearing herein are the property of their respective owners.

©Vest Group Inc 2025. All rights reserved.

Vest Trademarks & Copyrights

Risk Factors

Investments involve risks. Principal loss is possible. The value of an investment will fluctuate and may be worth more or less than the original investment. There can be no guarantee that the fund will be successful in its strategy to provide a hedge against declines below a floor in the 10-year rate over a quarter.

Swaptions Risk. The Fund will invest in swaptions. A swaption is an option contract that gives the holder the right (but not the obligation) to enter into a swap at a predetermined rate at expiration in exchange for a premium payment. Swaptions enable the Fund to purchase exposure that is significantly greater than the premium paid. Consequently, the value of swaptions can be volatile, and a small investment in swaptions can have a large impact on the performance of the Fund. The Fund risks losing all or part of the cash paid (premium) for purchasing swaptions. Additionally, the value of the option may be lost if the Fund fails to exercise such option at or prior to its expiration.

Interest Rate Swaps Risk. The Fund will invest in interest rate swaps. In an interest rate swap, the Fund and another party exchange their rights to receive interest payments based on a reference interest rate. Because interest rate movements do not always align with projections of a swap counterparty, interest rate swaps are subject to interest rate risk. An interest rate swap could result in losses if the underlying asset or reference does not perform as anticipated.

Counterparty Risk. The risk of loss to the Fund for derivative transactions (such as interest rate swaps or swaptions) that are entered into on a net basis depends on which party is obligated to pay the net amount to the other party. A counterparty may be unwilling or unable to make timely payments to meet its contractual obligations or may fail to return holdings that are subject to the agreement with the counterparty. If the counterparty or its affiliate becomes insolvent or bankrupt, or defaults on its payment obligations to the Fund, the value of an investment held by the Fund may decline.

Capped Upside Return Risk. To the extent that the Fund uses a derivatives instrument to cap the Fund’s return when the 10-year rate increases above a specified level at the end of the calendar quarter, the Fund will not participate in gains beyond the cap. In the event an investor purchases shares after the date on which the Fund enters into such derivative instruments (i.e., at the end of each calendar quarter) and the 10-year rate has risen to a level near to the cap, there may be little or no ability for that investor to experience an investment gain on their shares with respect to the 10-year rate during that quarter.

Floor Loss Risk. There can be no guarantee that the Fund will be successful in its strategy to provide protection against declines below a floor in the 10-year rate over a calendar quarter. The Fund’s strategy seeks to hedge against increases in the 10-year rate, while limiting downside losses from a significant decrease in the 10-year rate, if shares are bought on the day on which the Fund enters into these derivatives and held until they expire at the end of the calendar quarter. In the event an investor purchases shares after the date on which the derivatives were entered into and the Fund has already increased in value, then the investor may experience losses prior to gaining the protection offered by the floor, which is not guaranteed. The Fund does not provide principal protection, and an investor may experience significant losses on its investment, including the loss of its entire investment.

ETF Risk. ETFs may trade at a premium or discount to NAV. Shares of any ETF are bought and sold at market prices (not NAV) and are not individually redeemed from the Fund. Brokerage commissions will reduce returns.

Please see the prospectus for more information regarding these and other risks associated with the Fund.

Vest Financial LLC is an investment advisory firm registered with the U.S. Securities and Exchange Commission (SEC). Registration does not imply a certain level of skill or training. Vest Financial LLC is a wholly owned subsidiary of Vest Group Inc. Vest offers institutional-quality Target Outcome Investments(R) built on the backbone of its unique investment philosophy—that strive to buffer losses, amplify gains or provide consistent income — to a diverse spectrum of investors.