Guide to the

Target Buffer Strategy

The Target Buffer Strategy is a type of hedged equity investment strategy, designed to help equity investors:

- maintain a level of protection in down markets

- take advantage of growth opportunities in up markets

The strategy is available in:

- buffer ETFs (also known as “defined outcome ETFs” or “Target Outcome ETFs®”)

- buffered notes

- buffered annuities (also known as “Registered Index-Linked Annuities”)

- buffer mutual funds

- buffer UITs (unit investment trusts)

- buffer CITs (collective investment trusts)

This 2-minute video is an example of how the Target Buffer Strategy works, in point-to-point and laddered products.

This guide provides an in-depth discussion of the Target Buffer Strategy:

how it works, how it’s built, and where it can fit in the portfolio, along with tools for combining Target Buffer Strategies to achieve specific objectives, and more.

Why invest in the Target Buffer Strategy?

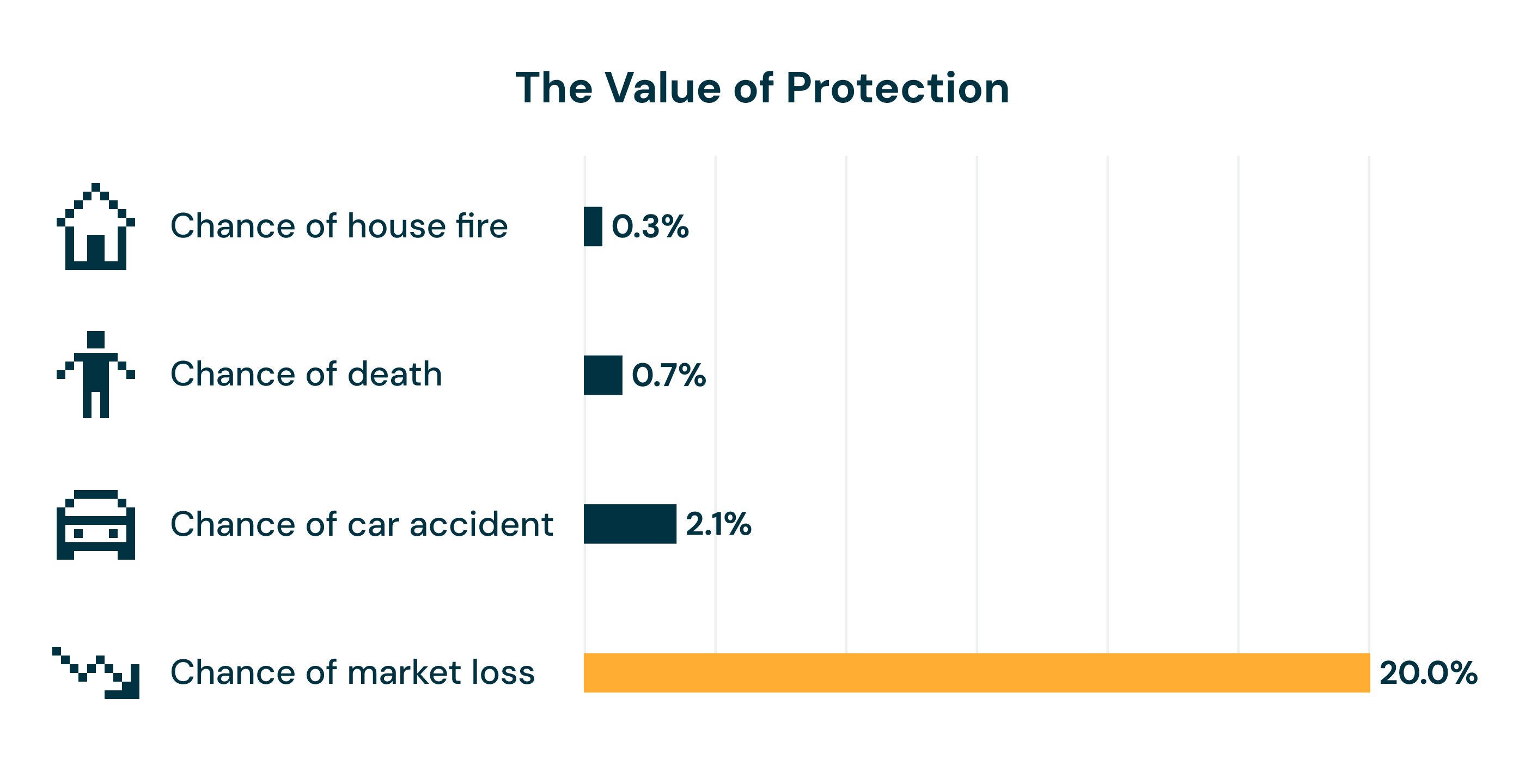

We buy protection on our homes, on our cars and even on our lives. However, in any given year with a 20% chance of market loss, why don’t more investors protect their investments?

Equities offer promising growth potential for investments, but equities can be severely affected by events that are difficult to predict. Losses can have a greater impact on investments than gains, because the money left after the loss has to work harder just to get back to the original levels.

The Target Buffer Strategy offers an innovative approach that seeks to strike the right balance: aiming to provide a persistent level of protection to equity exposure while allowing investors to participate in some of the potential growth opportunities that equities provide.

Investors often rely on market timing or diversifying equities with bonds to help minimize their risks from losses. But these strategies may be challenged in some market environments.

- 60/40 may not be the answer

Many portfolios include an allocation to fixed income as a counterbalance to equities during times of market volatility. However, bonds and equities may decline simultaneously, negating the expected counterbalance benefit of diversification. Fixed income may also be challenged when interest rates rise and lose purchasing power in an inflationary environment.

- Being cautious does not mean being in cash

Investors who sell in market downturns and wait on the sidelines in cash for the market to recover can miss out on top-performing days, which can have a big impact on returns.

When will the next pullback occur, or when will interest rates or inflation rise? While it’s not possible to predict the future, there are ways to prepare for it.

The Target Buffer Strategy seeks to protect equity investors from losses with a contractual level of certainty (“contractual certainty”) that is simply not possible with a 60/40 allocation or market timing. The contractual certainty comes from options, which we will explore further. To understand the contractual nature of options and why it matters, click here.

How it works

The Target Buffer Strategy is designed to protect investors from a specific level of downside losses in a reference asset while allowing participation in potential growth up to a predetermined cap for a specific outcome period.

The strategy has four key elements:

- Reference asset

An ETF such as the SPDR® S&P 500 ETF Trust (SPY), or an index such as the S&P 500 Index (SPX).

- Downside buffer

Buffers are set for the reference asset at the start of each outcome period based on volatility and other factors. Typical buffer or “power buffer” levels are from 0 to -10% or 0 to -15%, while deeper “ultra” buffers can protect against downside losses in the -5% to -30% or -5% to -35% range.

- Outcome period

A term, such as a 1-month or 1-year period, for which losses are buffered.

- Upside cap

Typically, there is a cap on potential upside gains, which pays for the downside buffer. Caps are set at the start of the outcome period.

The strategy seeks outcomes (before fees and expenses) that are a function of the level of the reference asset at the end of the outcome period relative to its level at the start, as illustrated below below (in each case before any fees and expenses)

If the reference asset appreciates more than the cap level:

The Target Buffer Strategy seeks to provide an outcome aligned with the predetermined cap level.

If the reference asset appreciates, but less than the cap level:

The Target Buffer Strategy seeks to provide an outcome that increases by the percentage increase of the reference asset, up to the predetermined level.

If the reference asset decreases by less than the buffer:

The Target Buffer Strategy seeks to not participate in such losses.

If the reference asset decreases by more than the buffer:

The Target Buffer Strategy seeks to provide an outcome that is better than the price returns of the reference asset by the buffer percentage.

Choose a downside buffer for a hypothetical Target Buffer Strategy using SPDR® S&P 500 ETF Trust (SPY) as the reference asset.

Downside Buffer

Adjust the SPY price return to see the types of outcomes the target buffer strategy would seek based on the reference asset.

IMPORTANT: This tool is for illustrative purposes only and is not intended to be indicative of future results of the strategy. The projections or other information generated by this tool are hypothetical in nature, do not reflect actual investment outcomes and are not a guarantee of future results. Hypothetical target outcomes do not reflect fees or expenses that may apply.

The information presented is not intended to constitute an investment recommendation for, or advice to, any specific person. Investors are responsible for evaluating investment risks independently and for exercising independent judgment in determining whether investments are appropriate for them. The targeted outcomes may only be realized if investors are holding shares at the beginning of the outcome period and continue to hold them on the last day of the outcome period. There is no guarantee that the strategy will be successful in its attempt to provide the targeted outcomes. There is no guarantee that the strategy will be successful in its attempt to provide the targeted outcomes.

The Target Buffer Strategy aims to protect an investment through the use of options, which have contractual features that provide a formulaic payment based on the performance of a reference asset. The payment for options is dependent on the performance of the reference index being above (in case of a call option) or below (in case of a put option) a predetermined price (strike price) on a specific date in the future (exercise date). The contractual nature of options makes them similar to personal property insurance contracts, as they make a payment on a future date that is contingent on an event taking place.

The Target Buffer Strategy is constructed from a combination of call and put options with an expiry corresponding to the outcome period, overlaid on an exposure to the reference asset. The overlay strategy has two components, as illustrated in the following example where the reference asset is the S&P 500 and the downside buffer is 0 to -10%.

- Protection component

The strategy includes buying a put spread on the S&P 500 Index — a combination of buying a put option on the S&P 500 Index with a strike price that is close to the level of the S&P 500 Index and selling a put option on the S&P 500 Index with a strike price that is approximately 10% lower than the level of the S&P 500 Index. The strategy must pay an upfront premium in exchange for the right to profit from the index’s decline between the level of the S&P 500 Index and approximately 10% lower than the level of the S&P 500 Index. This potential profit from the options overlay offsets the losses from the existing exposure to the S&P 500 Index and is what creates the protected downside range of the Buffer Strategy.

- Capped component

The strategy sells call options on the S&P 500 Index to give up the right to the index’s future price appreciation above the strike price, in exchange for upfront premium income, which creates the capped upside range of the Buffer Strategy. The strike price of the call options sold and, as a result, the upside cap level is set such that the premium paid for the protection component of the strategy equals the premium collected for the capped component of the strategy.

How to invest

Buffered notes and buffered annuities provide access to the Target Buffer Strategy and provide similar targeted outcomes, but may have unique risks, including concentrated credit risks, lack of transparency and lack of liquidity.

In 2016, Vest launched a mutual fund which was the first 1940 Act product to offer access to the Target Buffer Strategy, in a potentially more transparent, more liquid and more familiar investment vehicle. Today the strategy is available in various investment products offered by Vest and its partners.

Our Products

Vest provides various versions of Target Buffer Strategies on different reference assets, with different levels of protection, over different outcome periods. Prospective investors can use the Estimated Cap Tool to see estimated caps in the current market environment for hypothetical Target Buffer Strategies.

Target Buffer Strategies are available as single, “fixed-term” strategies and diversified, “laddered” strategies (as seen in the video at the top of the page). Investors often ask whether to invest in a fixed-term or laddered strategy. The optimal approach usually depends on the investment objective and risk tolerance.

Fixed-term strategies, which provide a solution over a specific investment term, can assist investors in timing the market or hedging tactically. A ladder of Target Buffer Strategies, on the other hand, can diversify timing risk, similar to how laddered bond portfolios seek to manage timing risks for bond investors.

Learn more about laddering.

In general, sound practice is for investors to consider:

- Using a diversified/laddered approach for a strategic ongoing level of protection.

- Using fixed-term strategies for tactical trading/protection.

The research paper on S&P 500 Index Buffer Strategies discusses the two approaches in depth, and provides guidance on fitting the portfolio design to investment goals.

Where it fits in the portfolio

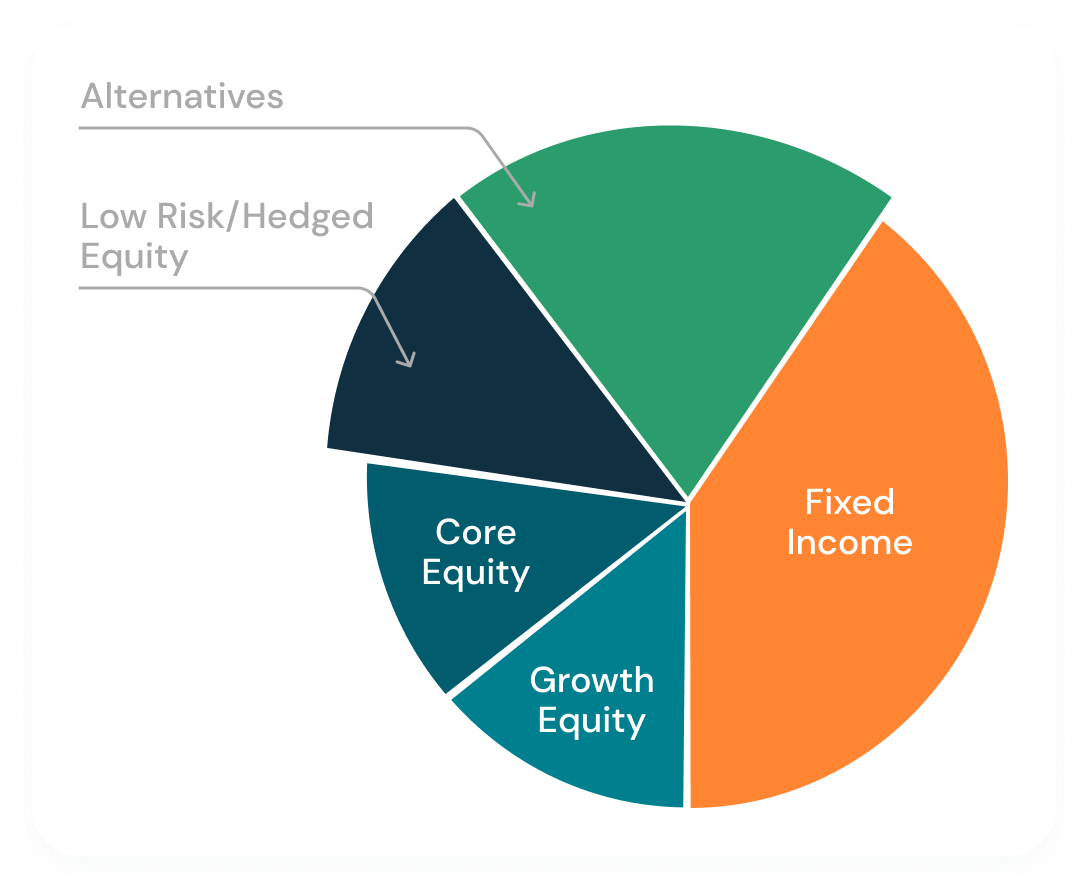

The Target Buffer Strategy can fit in two places in an investor’s portfolio:

- Low Risk/Hedged Equity

A common way to reduce downside risk is to lower the allocation to equities. However, this creates the risk of missing out on potential upside. The Buffer Strategy, in contrast, seeks to deliver some potential upside from equities with reduced downside risk, allowing investors to stay persistently invested.

-

Alternatives

The Buffer Strategy’s risk/return characteristics provide lower downside risks through capping some upside, similar to alternative investments such as hedged funds. As a result, the Buffer Strategy may be used as a potentially cost-competitive replacement to hedge funds.

The white paper, Risk Management 2.0, provides a quantitative risk/return framework for evaluating Buffer Strategies in the context of traditional 60/40 and 50/50 equity/bond allocations and guidance on how to deploy them in investment portfolios.

Tools

Fixed-term Target Buffer Strategies with varying levels of protection can be “blended” or combined to achieve specific risk objectives and/or potentially improve the risk/return of multi-asset portfolios.

For example, an investor may invest in an 80%/20% blend of “Buffer” (0 to -10% protection) and “Deep Buffer” ( -5% to -30% protection) Strategies, respectively, beginning in a specific month, in pursuit of a specific risk objective.

The Scenario Analyzer Tool can help you explore potential blends of strategies and corresponding potential target outcomes for various reference asset levels and scenarios.

The Target Buffer Strategy is designed to protect an investment over a specific outcome period, and its value is determined by the price of the reference asset at the end of the period. Because Target Buffer ETFs and mutual funds offer liquidity and price transparency, investors have the flexibility to purchase or sell them during the outcome period.

These “intraperiod investors”—who invest in the strategy after it starts, or sell before it ends—will, however, have different outcomes than individuals who invested at the inception and held the Target Buffer ETFs or mutual fund until the end of the outcome period.

The Intraperiod Pricing Tool can help you explore potential intraperiod outcomes based on the Black-Scholes model.

The tool takes into account the remaining time in the outcome period, along with investors’expectations of volatility, dividend, interest rate, and price of the reference asset.

The Target Buffer Strategy is designed to target a specific level of protection – and uses the contractual certainty of options to that end. The actual performance of each buffer investment is contingent on the product design and the expertise of the portfolio management team running the strategy. There are a number of potential issues that can lead to slippage, such as distributions, dividends, poor tax management, etc.

Reviewing the performance of buffer investments that have completed their outcome period compared to the performance of the reference asset and relative to the stated investment objective can give investors a sense of the prowess of the manager.