Vest Bitcoin Strategy Managed Volatility Fund

The first mutual fund providing access to Bitcoin Futures, with a built-in strategy to manage volatility. The fund does not invest directly in bitcoin.

“Investors have been eager for access to Bitcoin, and until recently were challenged to access Bitcoin-related returns in a brokerage account. However, the cryptocurrency's volatility has been concerning to some. We set out to solve those issues, in a novel way.“

Why invest in this fund

Originally proposed in a 2008 white paper, Bitcoin was envisioned as “a purely peer-to-peer version of electronic cash” and has since grown into a global financial and technological phenomenon. Today Bitcoin is the most established cryptoasset in the world, with a 10+ year track record and the largest base of users in the cryptomarket.

In 2021, investors gained access to Bitcoin-related returns via a limited number of Bitcoin Strategy mutual funds and ETFs. The shares of these funds can be purchased and sold conveniently in most brokerage accounts, without the need to manage separate cryptocurrency exchange accounts or wallets.

While Bitcoin prices have soared in the past, the ride has been turbulent. The price of the cryptocurrency swings significantly up and down, meaning that it is highly volatile. Relative to more traditional assets like stocks, bonds, and government currencies, Bitcoin has been significantly more volatile, sometimes as high as 5 times more volatile relative to the U.S. stock market. Its volatility has exposed investors to sizeable losses in the past.

The Fund offers an innovative approach that seeks to soften the swings of Bitcoin. By actively adjusting allocations to Bitcoin Futures, Options that reference Bitcoin Reference Assets, and cash, the Fund aims to provide exposure to Bitcoin with less volatility. This has the potential to mitigate the impact of drawdowns and poor market timing, while potentially improving risk-adjusted returns.

How it works

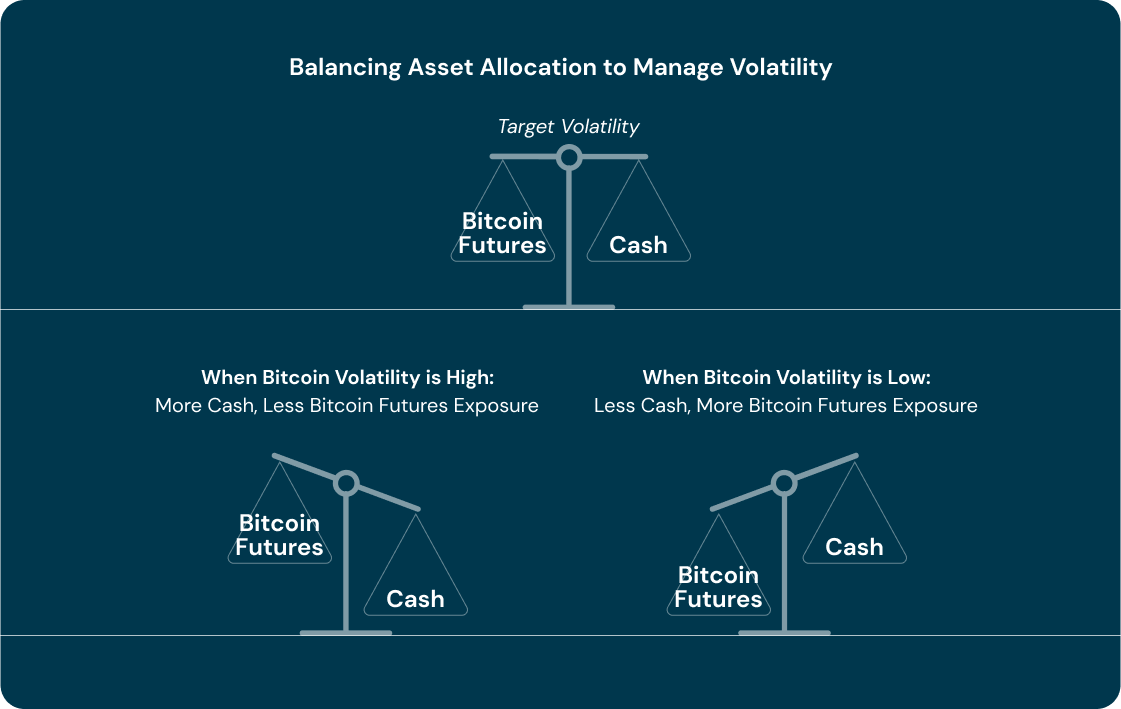

The Fund provides access to Vest’s “Managed Volatility Strategy.” The strategy utilizes Bitcoin Futures and Options that reference Bitcoin Reference Assets that seek to deliver returns linked to the price of Bitcoin while managing its volatility to reduce the impact of severe sustained declines.

The strategy seeks to target levels of volatility set by the Fund’s manager by dynamically changing the Fund's allocation to Bitcoin Futures, Options that reference Bitcoin Reference Assets, and cash investments. Generally:

- When volatility experienced by Bitcoin is high, the Fund looks to decrease its exposure to Bitcoin Futures and Options that reference Bitcoin Reference Assets..

- When volatility experienced by Bitcoin is low, the Fund looks to increase its exposure to Bitcoin Futures and Options that reference Bitcoin Reference Assets..

The Fund’s manager believes that the Managed Volatility Strategy may lead to total returns for investors while dampening large swings in the volatility of the Fund’s entire portfolio over time. However, historically realized volatility may not be indicative of future volatility. Due to this limitation, changes in market conditions, or other factors, the actual realized volatility of the Fund for any particular period may be materially higher or lower than the volatility targeted by the Fund’s manager. The return of the Fund for any given period could be directionally different than the returns of Bitcoin, Bitcoin Futures, or Options that reference Bitcoin Reference Assets depending on depending on allocation decisions made by the Fund’s manager in its attempt to implement the Managed Volatility Strategy.

Where it fits in the portfolio

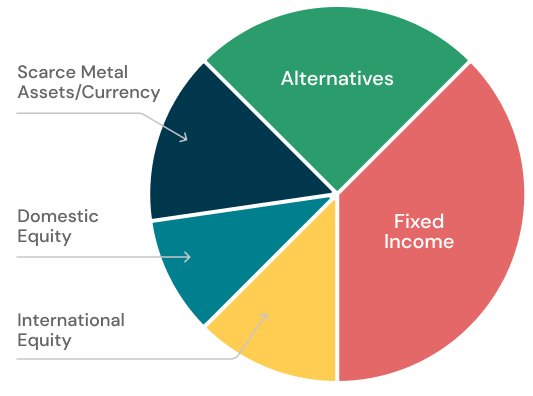

The Fund may be of interest to those seeking exposure to:

- Scarce Metal Assets/Currency Allocation

- Alternatives

Bitcoin Futures and Options that reference Bitcoin Reference Assets may be considered an alternative to assets such as gold or currencies as a store of value. Portfolio strategies that incorporate such assets or currencies to diversify holdings or hedge against inflation may consider allocating to the Fund.

Bitcoin Futures and Options that reference Bitcoin Reference Assets may provide exposure that can be unique relative to other traditional assets such as stocks or bonds.

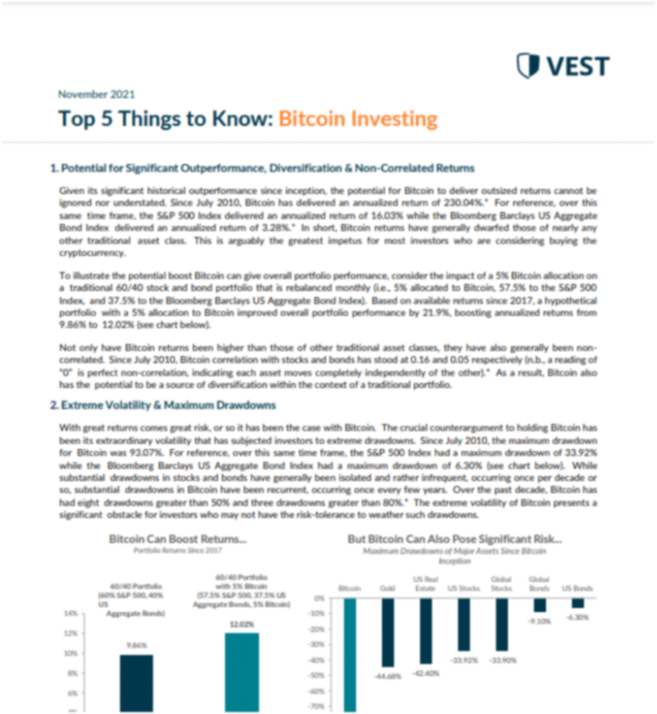

See the impact of a 5% allocation to Bitcoin on a 60/40 portfolio, starting in 2017.

Performance

This chart illustrates the performance of a hypothetical investment made in the Fund. It is net of fees and transaction costs. This chart does not imply any future performance.

| 1 mo. | 3 mo. | YTD | |

|---|---|---|---|

| BTCVX, at NAV | -16.68% | -20.90% | -18.22% |

All performance data greater than one year is annualized.

Performance data quoted represents past performance. The Fund's past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance data quoted. You may obtain performance data current to the most recent month end by calling 855-505-VEST (8378).

* Fund performance inception: 08/13/2021

Fund facts & stats

Fund Snapshot

- Ticker BTCVX

- CUSIP 98148L308

- Inception Date 8/13/2021

- Gross Expense Ratio2.01%

- Net Expense Ratio* *0.99%

Estimated Distributions

Additional resources & FAQs

Regulatory Documents

FAQs

What is Bitcoin?

What is a futures contract?

How are futures contracts exercised?

How does a Bitcoin futures contract work?

How is the price of Bitcoin determined?

What is a drawdown?

What is volatility?

What is an option?

What is a call option?

Start investing

The Fund is open to individual and institutional investors, and can be purchased through a financial professional or in brokerage accounts at Charles Schwab , Fidelity , Interactive Brokers , and many other leading investment firms. Contact Us for assistance if your platform is not listed. Carefully review the information about the Fund and read the prospectus to see if the Vest Bitcoin Strategy Managed Volatility Fund is right for you.

The power of derivatives, simplified

Build more certainty into portfolios with defined outcomes.

Let’s connectImportant Disclosures, Please Read

Investors should consider the investment objectives, potential risks, management fees and charges and expenses carefully before investing. This and other information is contained in the Fund’s prospectus, which may be obtained online, or by calling 855-505-VEST (8378). Please read the prospectus carefully before investing. Distributed by Foreside Fund Services, LLC, Portland, ME. Member FINRA/SIPC.

View this firm's background on FINRA's BrokerCheck.

On January 2, 2024, the Fund’s name changed from Cboe Vest Bitcoin Strategy Managed Volatility Fund to Vest Bitcoin Strategy Managed Volatility Fund. This is a change in name only; the Fund’s objective and principal investment strategy remain the same.

Any comments or statements made herein do not reflect the views of Vest Group Inc. or any of their subsidiaries or affiliates.

The Fund will not directly invest in Bitcoin or any other digital currency. Bitcoin Futures contracts and Options that reference Bitcoin Reference Assets involve the risk of mispricing or improper valuation and changes in the value of a futures and options contract may not correlate perfectly with price of Bitcoin.

An investment in the Fund involves a substantial degree of risk. Investors in the Fund should be willing to accept a high degree of volatility in the price of the Fund's shares and the possibility of significant losses.

The trademarks and service marks appearing herein are the property of their respective owners.

The Schwab name and Schwab logo are the trademarks of Charles Schwab & Co., Inc.

Interactive Brokers® is a trademark of Interactive Brokers, LLC

Risk Factors

The Fund will invest in exchange-traded Bitcoin futures contracts and options that reference bitcoin reference assets that can be highly volatile. Using futures and options can increase the volatility of the Fund’s net asset value (“NAV”) and/or lower total return. A liquid secondary market may not always exist for the Fund’s futures contracts or options positions at any time. The Fund may experience high portfolio turnover which may result in higher taxes when held in a taxable account. The market for exchange-traded Bitcoin futures contracts and options that reference bitcoin reference assets has limited trading history and operational experience and may be riskier, less liquid, more volatile and more vulnerable to economic, market and industry changes than more established futures and options markets, thus impacting the performance and risk profile of the Fund. The NAV of the Fund over short-term periods may be more volatile than other investment options because of the Fund’s significant use of financial instruments that have a leveraging effect. Due to the Fund’s investment strategy of limiting its volatility, the Fund’s actual investment in Bitcoin Futures and options that reference bitcoin reference assets may be a small portion of the Fund’s overall assets.

The primary underlying asset of the future contract is Bitcoin, and the primary underlying asset of options that reference bitcoin reference assets is the Cboe Bitcoin U.S. ETF Index, which have several risks that could impact Bitcoin Futures, options that reference bitcoin reference assets, and the Fund. These risks, which could impact the price and value of Bitcoin, are: frequent or significant price movements; high levels of speculation; uncertainty as to growth in usage and in blockchain; an unregulated and uncertain regulatory environment; excess supply; instability and/or closure and shutdown of trading platforms for trading Bitcoin; the emergence of alternative digital assets and increased competition; reduction in supply; and increasing transaction fees. Together, the risks may result in changes in the confidence of investors. The prospectus provides complete details concerning risks of Bitcoin, the Fund, and investing in futures and options that reference bitcoin reference assets.

Futures contracts with a longer term to expiration may be priced higher than futures contracts with a shorter term to expiration, a relationship called “contango.” When rolling futures contracts that are in contango, the Fund may sell the expiring contract at a lower price and buy a longer-dated contract at a higher price, resulting in a negative roll yield. Conversely, futures contracts with a longer term to expiration may be priced lower than futures contracts with a shorter term to expiration, a relationship called “backwardation.” When rolling futures contracts that are in backwardation, the Fund may sell the expiring contract at a higher price and buy a longer-dated contract at a lower price, resulting in a positive roll yield. Due to contango, backwardation or other factors, the returns from Bitcoin Futures may differ from returns from a direct investment in Bitcoin, and an extended period of contango or backwardation may cause significant and sustained losses.

Option transactions in which the Fund may engage involve the following risks: the writer of an option may be assigned an exercise at expiration date of the option; disruptions in the markets for underlying instruments could result in losses for options investors; the insolvency of a broker could present risks for the broker’s customers; market imposed restrictions may prohibit the exercise of certain options; and the seller of an option is subject to the risk that the performance of its Bitcoin Reference Instruments will vary from the performance of the underlying index and the purpose of purchasing the option will not be fully achieved.

Please see the prospectus for more information regarding these and other risks associated with the Fund.

© 2025 Vest Group Inc. All rights reserved.

Vest Trademarks & Copyrights

Vest Financial LLC is an investment advisory firm registered with the U.S. Securities and Exchange Commission (SEC). Registration does not imply a certain level of skill or training. Vest Financial LLC is a wholly owned subsidiary of Vest Group Inc. Vest offers institutional-quality Target Outcome Investments(R) built on the backbone of its unique investment philosophy—that strive to buffer losses, amplify gains or provide consistent income — to a diverse spectrum of investors.