Introduction

Traditionally, retirement asset allocations have relied on the characteristics of two assets: stocks and bonds. In general, stocks fuel returns during the accumulation of retirement assets, while bonds hedge the risk of loss during the decumulation/distribution of assets in retirement.

However, this framework may not be as effective in the future as it has been in the past. This paper will analyze the current challenges facing existing retirement models and provide potential solutions for future retirement risk management.

Part I: Bonds Are Breaking

- Due to a variety of macroeconomic factors, evidence suggests that bonds may no longer be effective hedges to equity volatility.

- As portfolio managers strive to reduce the risk in their portfolios, it is becoming increasingly difficult to rely on bonds as an effective hedging instrument.

Part II: Form a New Foundation Built With Buffers

- Vest has developed two buffer strategies for retirement risk management that utilize the contractual certainty of stock options to achieve a desired level of risk while deriving underlying returns from “buffered” stock exposure.

Part III: Reengineering Retirement Portfolios With Buffers

- Combining the two strategies has the potential to provide better hedging qualities relative to bonds, as well as lower volatility relative to stocks.

- Given that current capital market assumptions indicate that stocks will provide lower returns with higher volatility in the future, the strategies may capture most of the upside of stocks while hedging excess volatility.

- In short, these buffer strategies have the potential to offer better hedging qualities relative to bonds, as well as lower volatility relative to stocks.

Part I: Bonds Are Breaking

Bonds have been the ballast of retirement risk management

A successful retirement plan requires an effective asset allocation. Risk and return must be carefully balanced in order to attain a desired outcome.

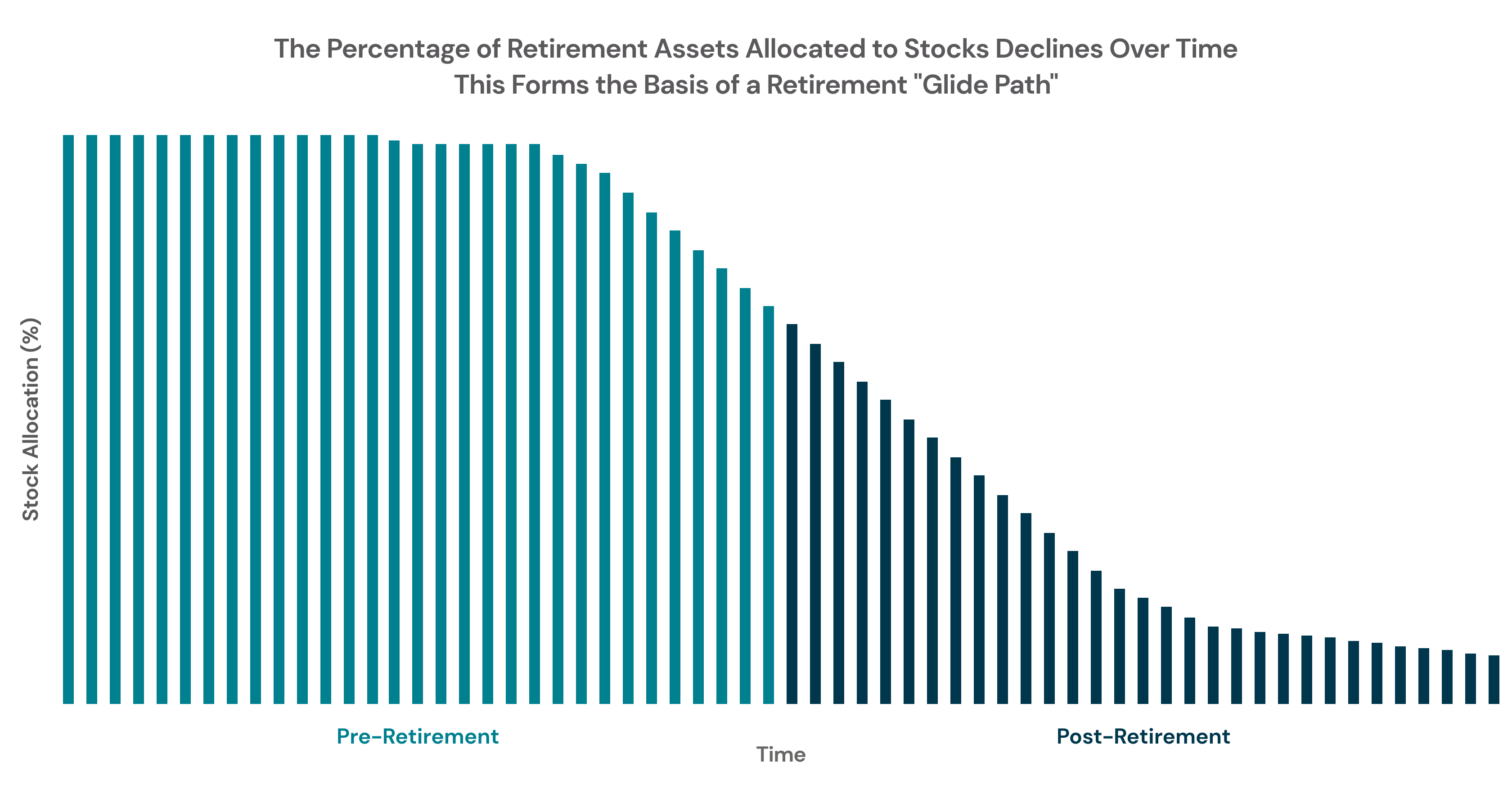

Traditionally, asset allocations have centered on the characteristics of two assets: stocks and bonds. In general, stocks fuel returns during the accumulation of retirement assets, while bonds hedge the risk of loss during the decumulation/distribution of assets in retirement. The percentage of the portfolio allocated to each asset changes over time. Early in the accumulation phase of a retirement plan, a high percentage of the portfolio is allocated to stocks. As an individual nears retirement, the percentage of stock holdings steadily declines as an incrementally greater percentage of the portfolio is allocated to bonds.

When displayed graphically, the “path” that stock allocations follow appears to “glide” downwards over time, thus the term “glide path.” In essence, the retirement glide path is an expression of a typical individual’s risk tolerance over time (see Figure 1).

Figure 1: Hypothetical Glide Path

While retirement assets have typically been allocated to stocks and bonds, adding a new risk management strategy has the potential to improve the current balance of risk and return. Risk management strategies that use options to offer exposure to “buffered” stock returns can provide a risk/return profile that falls between stocks and bonds. These strategies have the potential to offer better hedging qualities and improved returns relative to bonds, as well as lower volatility relative to stocks.

Bonds are sinking amidst turning tides in macroeconomics

For the better part of the past half-century, bonds have effectively hedged stock declines during waves of market volatility, making them